Income tax provision in accordance with asc 740 including m 1 adjustments. Minimum of 5 years of tax experience gained within a public accounting law firm or equivalent experience minimum of 3 years of specialized international tax consulting experience required including proficiency in both inbound and outbound topics.

Contract Manager Resume Sample At Lukoil Kickresume

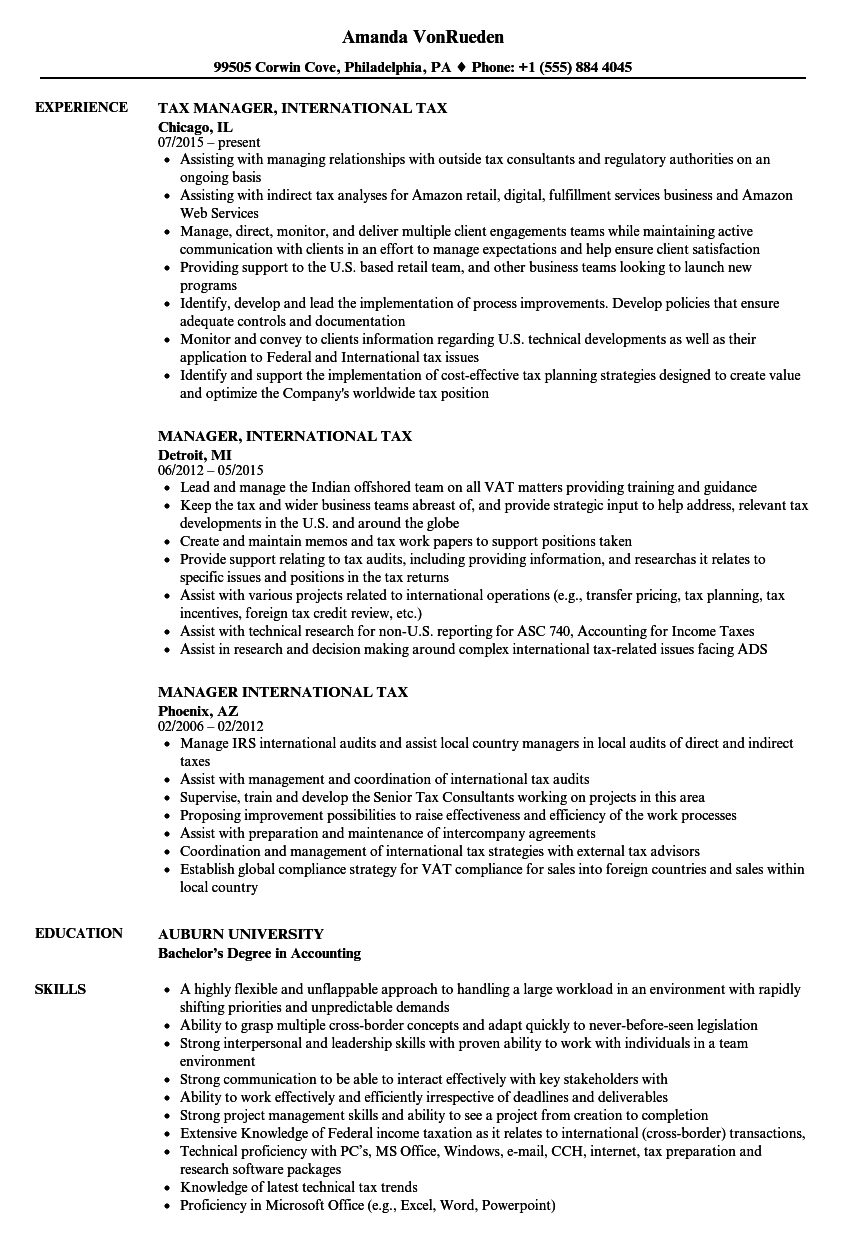

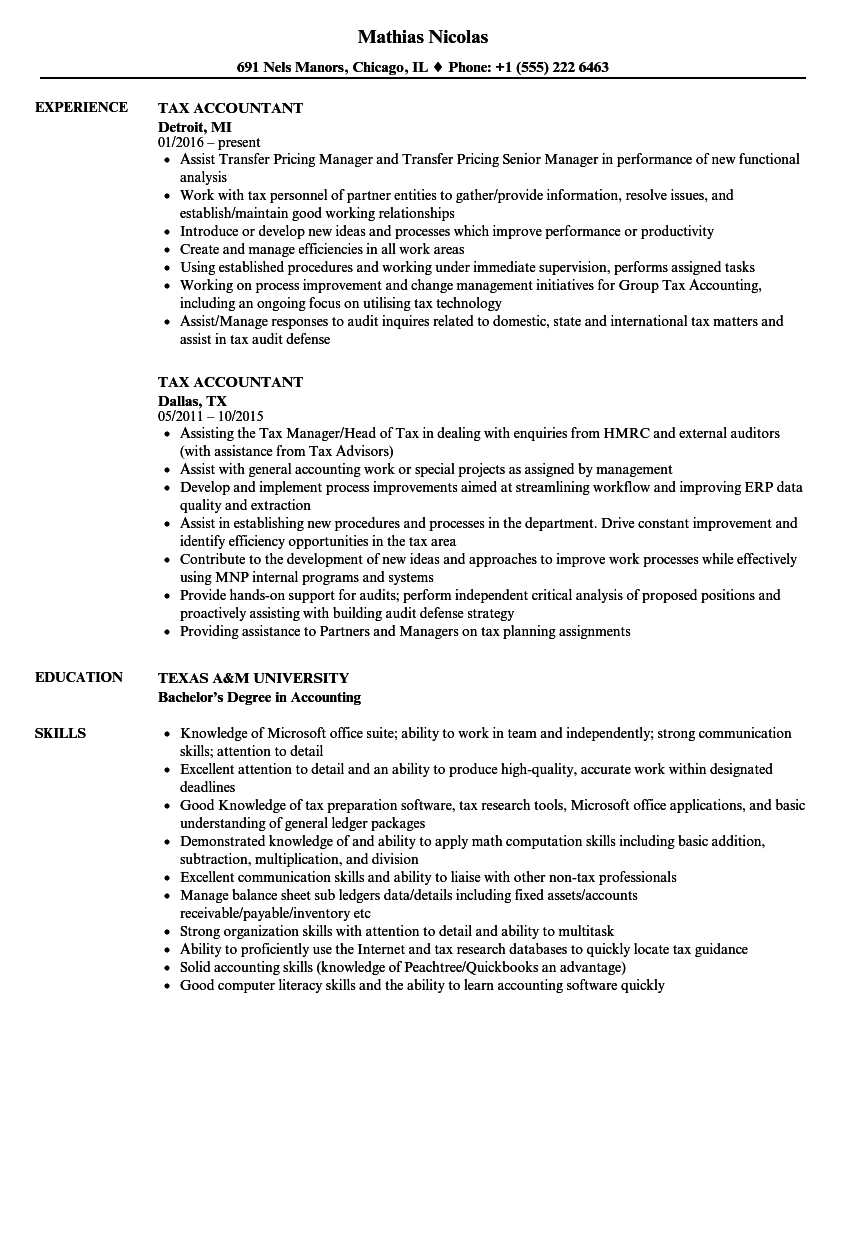

International tax manager resume. International tax manager resume samples 47 44 votes for international tax manager resume samples. Prepared and reviewed quarterly and annual us. Domestic and international tax and reporting compliance including federal consolidated multi state incomefranchise and international informational tax returns. Our certified professional resume writers can assist you in creating a professional document for the job or industry of your choice. Dynamic and highly qualified international tax manager with extensive experience in the interpretation and application of asc 740 and consulting and tax planning related to structuring and financing international operations offshore deferral repatriation and utilization of foreign tax credits. This resume was written by a resumemycareer professional resume writer and demonstrates how a resume for a international tax manager resume sample should properly be created.

Its actually very simple. Participating in developing testing and enhancing new tax provision applications. Tax managers handle a companys taxation issues and make sure the lowest possible amount of taxes is paid without breaking fiscal laws. The international tax manager responsibilities and tasks include working as a global tax administrator in the establishment. A tax director or tax manager is responsible for creating enforcing and overseeing a tax plan for a business or on behalf of an individual client. Heshe also plays the roles and duties of an international tax director.

International tax consulting manager resume examples samples. Guide the recruiter to the conclusion that you are the best candidate for the international tax manager job. Hisher functions vary from one nation to another. And preparing financial projections forecasts. Typical responsibilities of an international tax manager include. The guide to resume tailoring.

Overseeing compliance with tax regulation as it relates to specific business lines products or another concern of the organization delivering value in terms of calculating accurate projections of tax liabilities filing reports on time and within the requirements of the law and other things that advance the firms interests. Skills listed on a sample tax directors resume include analyzing brokerage statements for high net worth clients. The average sample resume for tax manager lists duties such as filling tax returns nurturing client relationships preparing various documents that will be submitted to tax authorities supervising taxation departments staff and helping with the completion. Pleasanton ca managed all aspects of us. Tax manager 012008 to 062015 the cooper companies inc.