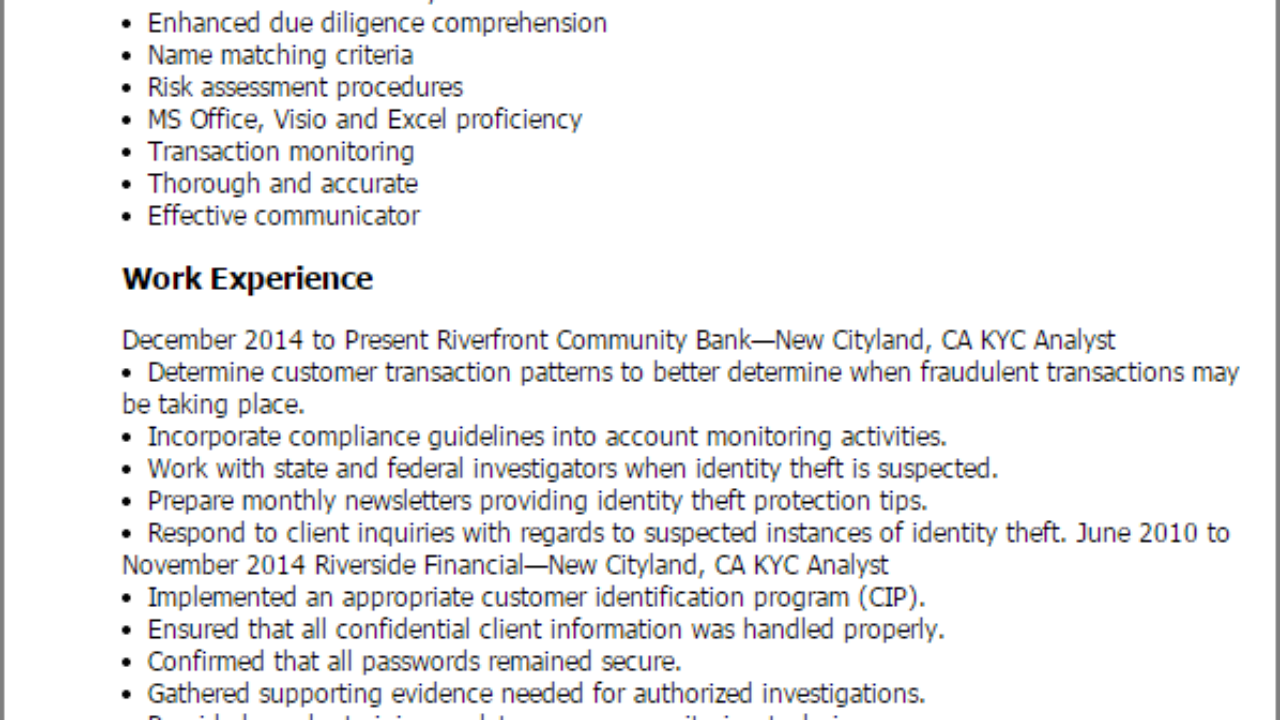

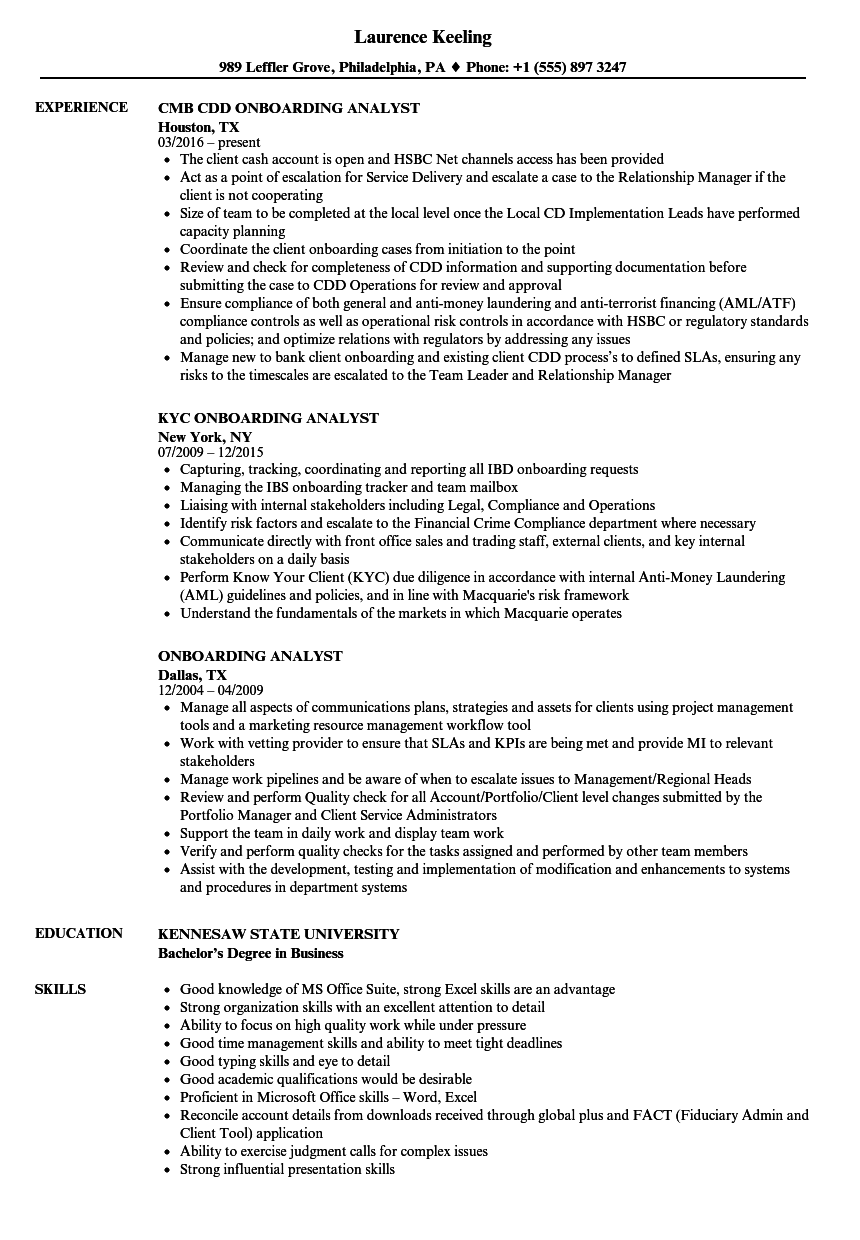

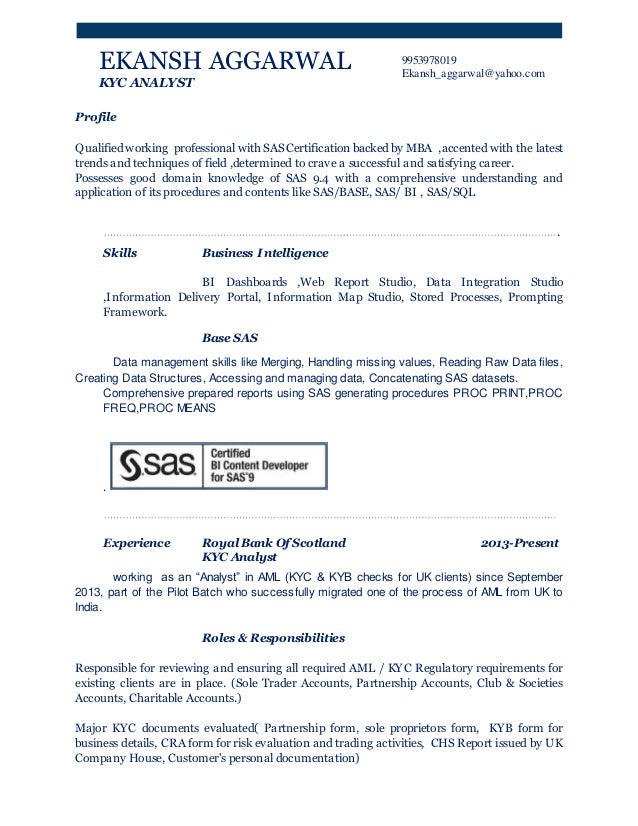

The anti money laundering aml analyst i may work on processing of due diligence sanctions filtering bank secrecycash reporting andor cip creating and maintaining appropriate files which will be reviewed by aml supervisory staff as well as internal external and regulatory examiners during annual audits and examinations. Kyc aml due diligence analyst 022006 current jpmorgan chase company jersey city nj verifies all aspects of client identification program cip and necessary account opening documents are provided and in accordance with know your customer kyc usa patriot act and bank secrecy act bsa standards.

Anti Money Laundering Analyst Resume Sample Mintresume

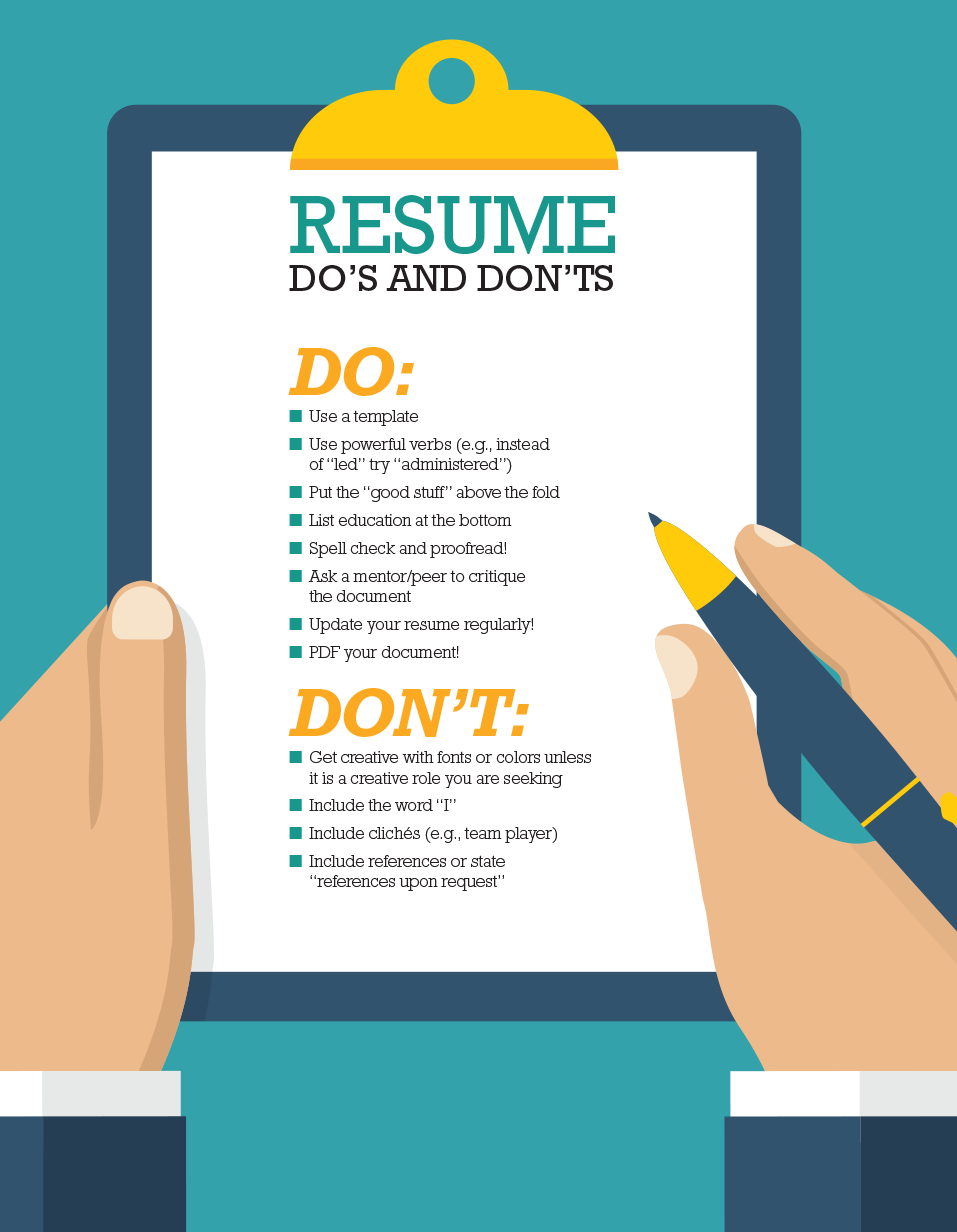

Aml kyc analyst resume. Senior aml kyc analyst resume examples samples. One penns way bldg 1 new castle de 19720 usa or irving texasduration. View all analyst resumes. Managed the business groups know your client process kyc and anti money laundering process aml in strict compliance with the us patriot act of 2001 section 326 cip. Responsibilities for aml kyc analyst resume prior experience in the field of anti money laundering kyc checks required a proven track record of relevant kycaml experience ie. Kycaml analyst reviewed consumer customers identified as requiring further analysis and made risk decisions based upon know your customer kyc standards.

12 months contract with possibility of extensionjob type. Approvals quality control and loan mortgage administration with large banks and financial institutions for instance promontory financial. Self motivated business professional with an excellent working relationship between all managing directors and national team members. Amlkyc quality control analyst location. There are plenty of opportunities to land a kyc analyst job position but it wont just be handed to you. The major duty of an aml compliance analyst is to monitor and detect suspicious transactionsas a means to prevent money laundering the aml compliance analyst resume mentions the following core duties and tasks verifying and processing currency transactions report forms using related tools for preventing theft and identifying theft losses efficiently monitoring currency transaction.

As a dedicated and resourceful banking professional with over 15 years of valuable experience in aml kyc cdd monetary transaction. Crafting a kyc analyst resume that catches the attention of hiring managers is paramount to getting the job and livecareer is here to help you stand out from the competition. Actively interviewing please confirm candidate location on resume while submittal. Working with key business areas to define new processes that meet required aml governance standards can be applied to the monitoring of transactions within the global markets business maintain an up to date knowledge of aml regulations. Quality assurance client onboarding compliance audit and regulation. Determined and implemented additional steps validating kyc risk compliance based on research of customer records verification of account purpose and legitimacy analysis of transaction activity.